In the dynamic world of forex trading, staying ahead of market fluctuations requires more than just intuition—it demands precision, adaptability, and automation. Enter the SmartDayMultiStrat EA V1.0 for MetaTrader 4 (MT4), an advanced Expert Advisor designed to automate trading strategies with a multi-faceted approach. This blog post delves into the features, benefits, and considerations of integrating this EA into your trading arsenal.

What Is SmartDayMultiStrat EA V1.0 MT4?

The SmartDayMultiStrat EA V1.0 is an automated trading system developed for the MT4 platform. Unlike traditional EAs that rely on a single trading strategy, this Expert Advisor incorporates six distinct strategies, each designed to operate independently. Traders can activate or deactivate these strategies based on their trading preferences and market conditions.

The six strategies included are:

- Gap Strategy: Identifies and trades price gaps at the daily candle open.

- Engulfing Strategy: Recognises bullish or bearish engulfing patterns for potential reversals.

- Harami Reversal Strategy: Detects Harami candlestick patterns signalling trend reversals.

- Continuation Strategy: Capitalises on strong momentum moves, continuing the previous day's direction.

- Reversal Strategy: Targets reversals when the price fails to sustain new highs or lows.

- Yesterday High-Low Breakout: Places BuyStop/SellStop orders based on the previous day's high and low, ideal for breakout trading.

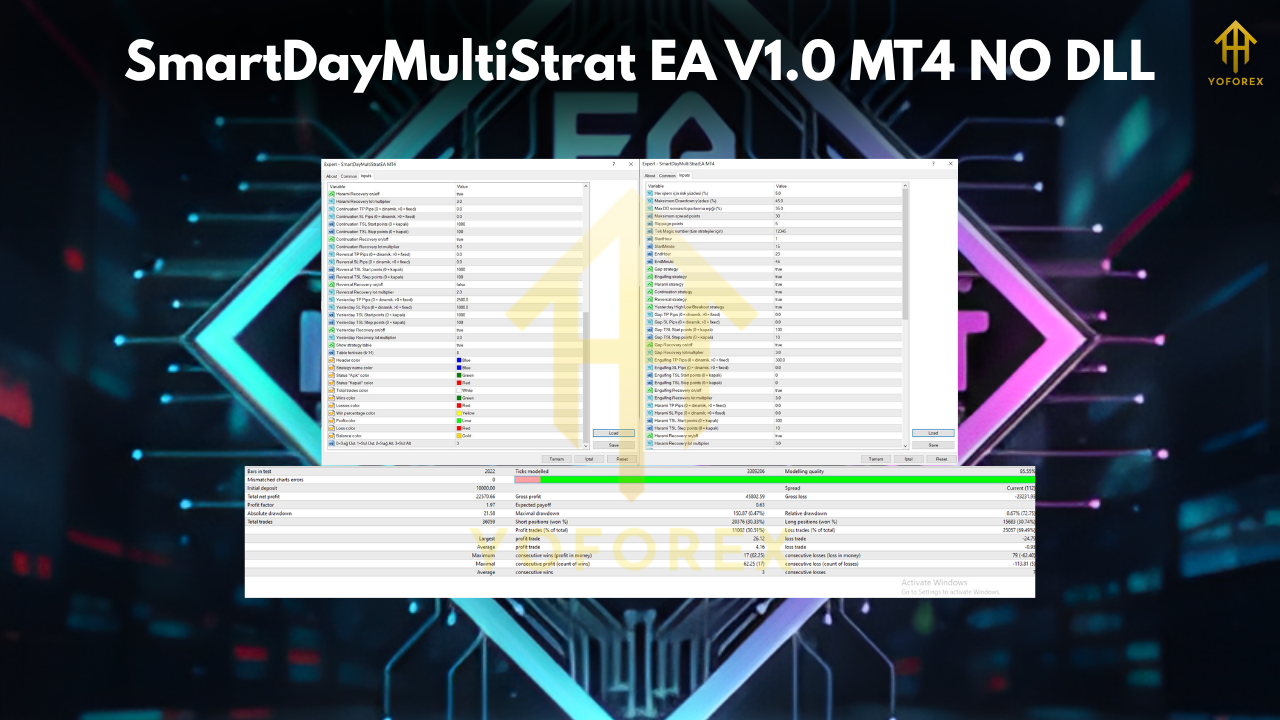

Each strategy comes with customizable parameters, allowing traders to fine-tune settings such as Take Profit (TP), Stop Loss (SL), and Trailing Stop Loss (TSL) to align with their risk tolerance and trading objectives.

Key Features and Functionalities

1. Modular Strategy Configuration

The modular nature of SmartDayMultiStrat EA allows traders to:

- Enable or disable individual strategies: Tailor the EA to focus on specific market conditions.

- Customise risk parameters: Adjust TP, SL, and TSL settings for each strategy.

- Implement recovery modes: Utilise customizable lot size multipliers to recover from losses.

This flexibility ensures that traders can adapt the EA to various market scenarios, enhancing its effectiveness.

2. Advanced Money Management

Effective risk management is crucial in forex trading. SmartDayMultiStrat EA incorporates:

- Risk percentage per trade: Set a specific percentage of the account balance to risk on each trade.

- Maximum drawdown protection: Prevents excessive losses by pausing trading after a set drawdown threshold is reached.

- Recovery threshold: Allows the EA to pause trading after significant losses, providing an opportunity to reassess strategies.

These features help safeguard capital and promote long-term profitability.

3. Time and Execution Filters

To optimise trade execution, the EA includes:

- Time filters: Restrict trading to specific hours, avoiding low-liquidity periods that can lead to slippage.

- Spread and slippage control: Ensures trades are executed only when the spread is below a set threshold and slippage is within acceptable limits.

These filters enhance the reliability and efficiency of trade executions.

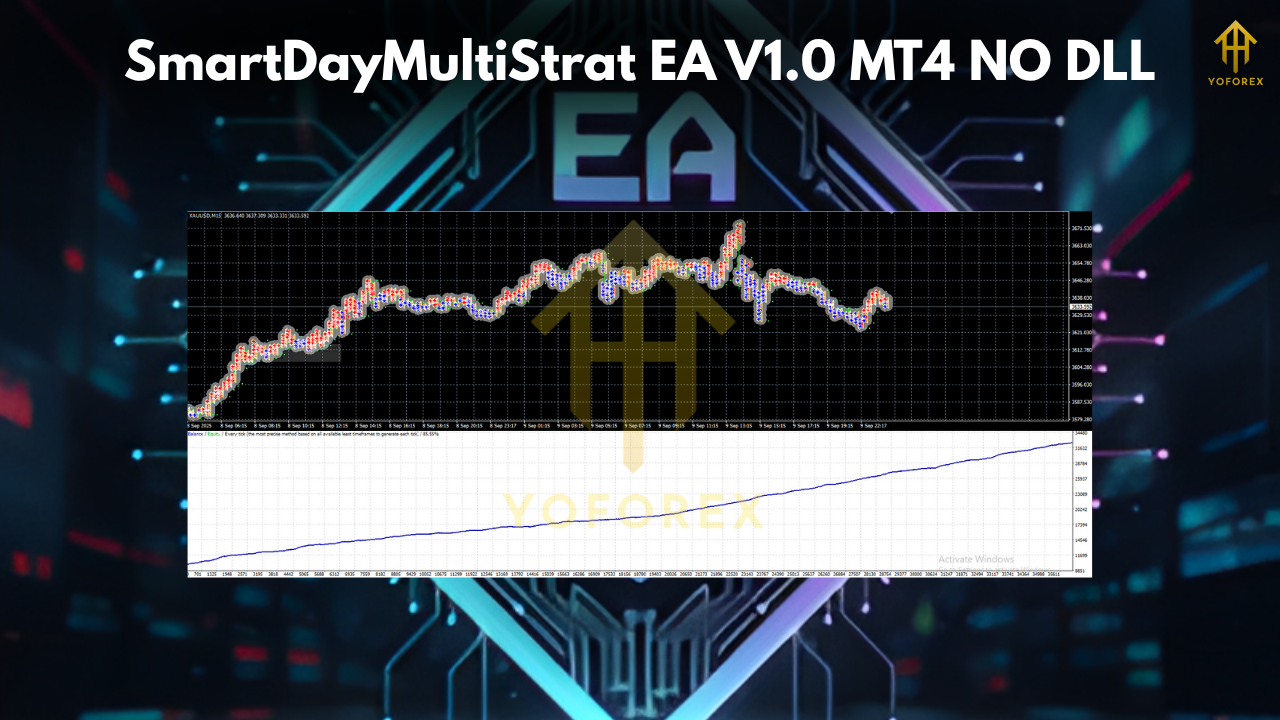

4. Real-Time Performance Dashboard

The on-chart performance dashboard provides:

- Strategy status: Indicates which strategies are active.

- Trade statistics: Displays the number of trades, wins, losses, and win percentage for each strategy.

- Account metrics: Shows current account balance and equity.

This transparency allows traders to monitor the EA's performance and make informed decisions.

5. Robust Error Handling and Logging

SmartDayMultiStrat EA features comprehensive error handling, including:

- Detailed logging: Tracks trade operations for troubleshooting and performance analysis.

- Error alerts: Notifies traders of any issues that may require attention.

These features ensure the EA operates smoothly and efficiently.

Benefits of Using SmartDayMultiStrat EA V1.0

- Diversification: The six independent strategies provide multiple trading opportunities, reducing reliance on a single market condition.

- Customisation: Traders can tailor the EA to their specific trading style and risk appetite.

- Automation: Automates trading decisions, eliminating emotional biases and ensuring consistent execution.

- Transparency: Real-time performance metrics allow for ongoing assessment and optimisation.

- Risk Management: Built-in safeguards help protect capital and manage drawdowns effectively.

Considerations Before Deployment

While SmartDayMultiStrat EA offers numerous advantages, traders should consider:

- Complexity: The multitude of strategies and settings may require a learning curve for optimal configuration.

- Market Conditions: The effectiveness of certain strategies may vary depending on market volatility and liquidity.

- Broker Compatibility: Ensure that the EA is compatible with your broker's execution model and spreads.

Thorough backtesting and forward testing on a demo account are recommended before deploying the EA on a live account.

Conclusion

The SmartDayMultiStrat EA V1.0 for MT4 stands out as a versatile and robust automated trading solution. Its multi-strategy approach, combined with advanced risk management features and real-time performance monitoring, makes it a valuable tool for traders seeking to automate their trading processes while maintaining control over their strategies.

By understanding its features and functionalities, traders can leverage SmartDayMultiStrat EA to enhance their trading efficiency and potentially improve profitability. However, as with any trading tool, it's essential to approach its use with caution, conduct thorough testing, and ensure it aligns with your trading goals and risk tolerance.

Comments

No comments yet. Be the first to comment!

Leave a Comment