ChatGPT said:

Radar Arrows Indicator V1.0 MT4 — Simple, Clear Buy/Sell Signals for Everyday Traders

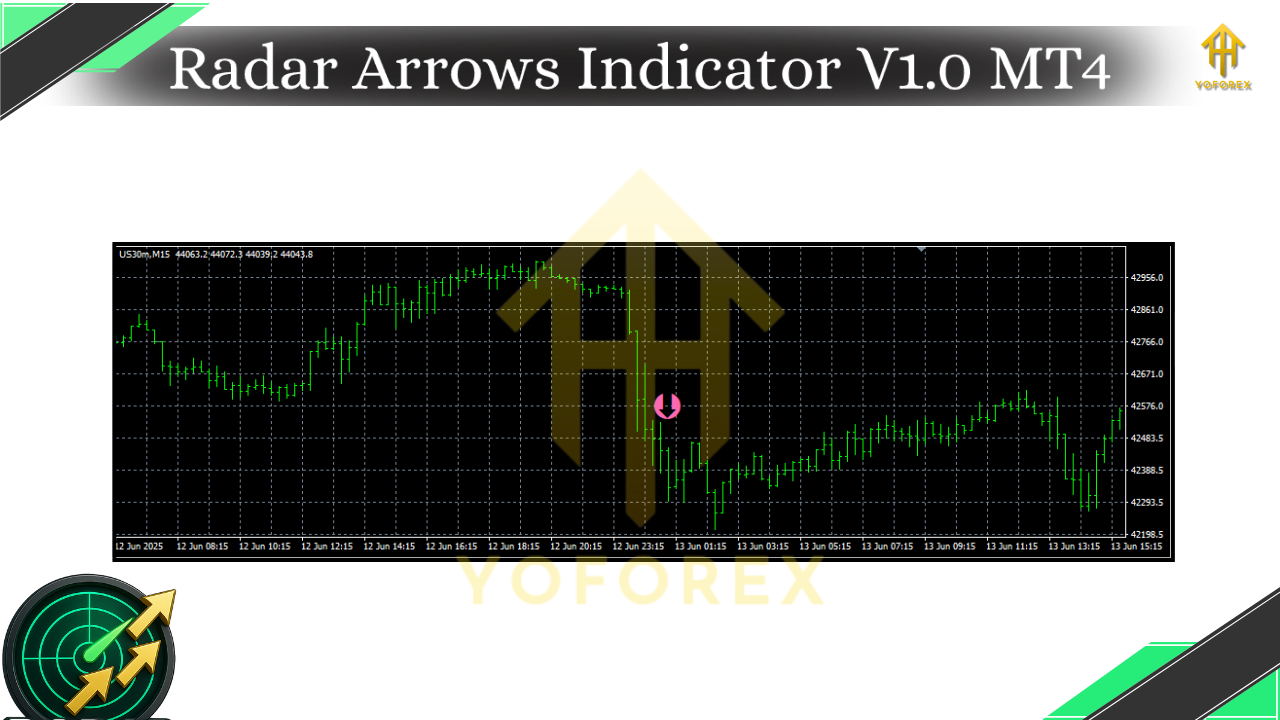

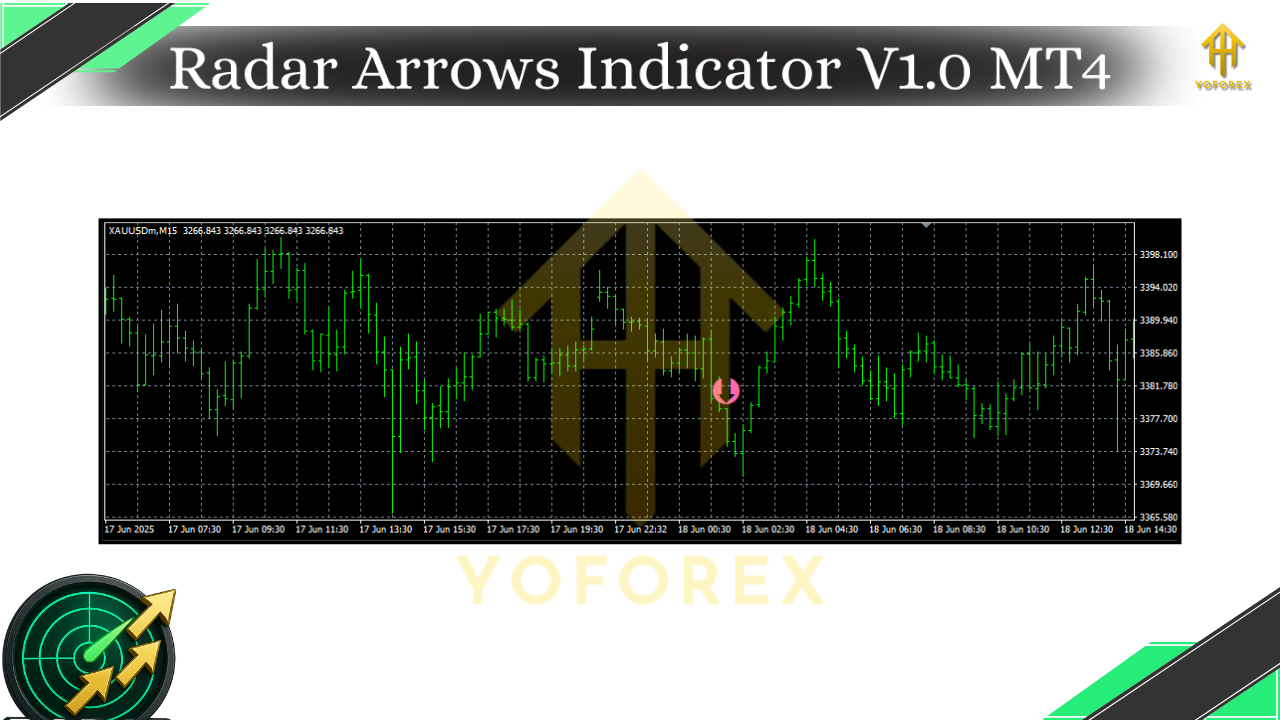

If you’ve ever stared at your MT4 charts wishing for a clean “just-tell-me-when-to-look” alert, the Radar Arrows Indicator V1.0 MT4 is exactly that kind of friend. It drops straightforward buy/sell arrows on the chart, so you don’t have to second-guess momentum shifts or clutter your screen with five different oscillators. It’s light, fast, and beginner-friendly—but with enough tuning under the hood to keep advanced traders happy, too. And yep, it plays nicely with scalpers, day traders, and swing traders alike.

What is the Radar Arrows Indicator?

The Radar Arrows Indicator is a visual signal tool for MetaTrader 4 (MT4) that helps you time entries by plotting arrows when certain momentum/confirmation conditions are met. Think of it as a “traffic light” on your chart—green to consider longs, red to consider shorts—so you can focus on execution and risk rather than hunting for patterns all day.

Unlike generic arrow tools that repaint heavily, Radar Arrows is designed to be stable on closed candles (i.e., the signal that prints at the close is the one you’ll see later). It’s not magic, and no indicator is perfect, but it aims to reduce noise while still catching meaningful moves. Pair it with basic trade management (stop-loss, position sizing, news awareness), and you’ve got a clean, repeatable workflow.

Why traders like it (in plain English)

- Clarity: Arrows are hard to misread. You instantly know when to pay attention.

- Speed: Signals are calculated efficiently, so it won’t bog down your platform.

- Confidence: Clear visual cues + optional alerts = less hesitation, fewer missed moves.

- Flexibility: Works across M5 to H4 timeframes and on most major pairs, XAUUSD, and even indices (with a bit of testing).

Key Features

- Arrow-based entries: Instantly spot potential long/short setups without chart clutter.

- Closed-candle confirmation: Designed to avoid repainting once the candle is closed.

- Multi-timeframe friendly: From M5 scalping to H1/H4 swings—tune to your style.

- Alert suite: Get MT4 pop-up, sound, email, and push notifications.

- Filter options: Optional trend filter to align with higher-timeframe direction.

- Adjustable sensitivity: Dial signals tighter for scalping or looser for swing trades.

- Minimal lag logic: Prioritizes timely signals over overly smoothed lag.

- Works on majors & gold: EURUSD, GBPUSD, USDJPY, XAUUSD, etc. (always demo first).

- Clean visuals: Arrows + optional color-coded background for quick context.

- Lightweight code: Optimized to run on multiple charts without stutter.

How it fits into a complete strategy

The Radar Arrows Indicator is best used as the entry timing layer on top of a simple plan:

- Direction bias: Use a 50/200 EMA or a higher-timeframe structure check (e.g., H1) to decide long-only or short-only bias for the session.

- Signal: Wait for the next Radar Arrow in the direction of that bias.

- Risk: Place stop-loss beyond a recent swing or a fixed ATR multiple (e.g., 1.5× ATR).

- Exit: Target a clean 1:1.5 to 1:2 R:R, or trail behind recent swing structure.

- Filter out noise: Skip signals during major red-folder news unless you’re explicitly trading news.

This approach keeps things simple; you’re not chasing every arrow—only those that match your bias and risk rules. You’ll be surprised how much that alone can cut the nonsense and help you stay consistent.

Recommended settings (starter presets)

These are starting points—always adapt based on your broker’s spreads and the pair’s volatility:

- Scalping (M5/M15):

- Sensitivity: Medium-High

- Trend Filter: On (uses higher-TF EMA or a built-in bias filter)

- Alerts: Push + pop-up

- Pairs: EURUSD, GBPUSD, XAUUSD (be mindful of gold’s volatility)

- Intraday (M15/M30):

- Sensitivity: Medium

- Trend Filter: On

- R:R: Aim 1:1.5+

- Add session filter (e.g., focus London/NY overlaps)

- Swing (H1/H4):

- Sensitivity: Low-Medium

- Trend Filter: On (heavier weight)

- Wider stops (ATR-based), fewer but higher-quality trades

Tips for better signals

- Respect structure: If price is slamming into a major daily level, wait for a clear reaction before acting on an arrow.

- Use ATR for stops: Fixed pip stops can be too tight on volatile pairs; ATR scales with conditions.

- One chart, one job: If you’re scalping, don’t also try to swing on the same chart—keep separate templates.

- Avoid chop: If you see back-to-back alternating arrows in a narrow range, step aside; that’s a clue the market is chopping.

- Journal it: Note which pairs/timeframes gave the cleanest follow-through; lean into those.

Installation & Setup (MT4)

- Copy the file: Drop the

.mq4or.ex4into File → Open Data Folder → MQL4 → Indicators. - Restart MT4: Or right-click → Refresh in the Navigator panel.

- Attach to chart: From Navigator → Indicators, drag Radar Arrows Indicator onto your chart.

- Configure inputs: Set sensitivity, enable/disable trend filter, choose alert types.

- Save template: Right-click chart → Template → Save so you can load it quickly on other pairs.

Backtesting & forward testing (smart approach)

While arrow indicators are visual, you can still bar-replay or use the Strategy Tester (visual mode) to assess historical behavior:

- Pick a sample period: 6–12 months on your target timeframe (e.g., M15 on EURUSD).

- Define rules first: Bias filter + entry arrow + stop/target; don’t curve-fit later.

- Track stats: Win rate, average R, max drawdown, and how many signals per day.

- Forward test on demo: 2–3 weeks of live observation will tell you more than any hindsight.

- Then go small live: Once comfortable, start with micro lots to validate execution and spreads.

You’ll notice the indicator excels when markets are moving with intention (post-breakout, session trends). In dead ranges, signals get noisier—that’s normal; use your filters and be picky.

Who is it for?

- Beginners who want a clean, rules-based visual trigger without reading ten indicators at once.

- Busy intraday traders who appreciate audible/push alerts and minimal guesswork.

- Swing traders who want confirmation on H1/H4 entries aligned with trend.

- System builders who like to combine a simple arrow with risk and structure for a lightweight, robust plan.

Common questions (quick answers)

- Does it repaint?

Signals are designed to remain on closed candles. Like any real-time tool, arrow states may evolve intra-bar, but once the bar closes, the arrow you see is intended to stay. - Which pairs are best?

Major FX pairs (EURUSD, GBPUSD, USDJPY) and XAUUSD are popular. Always demo first. - What about prop firms?

It’s an indicator, not an EA. It can be part of a prop-friendly manual strategy if you respect daily drawdown and risk limits. - Can I use it with EAs?

Many traders run it alongside EAs as a visual confidence layer or to filter manual overrides.

Final word

The Radar Arrows Indicator V1.0 MT4 won’t replace your judgment—but it will reduce analysis fatigue, keep charts tidy, and give you a crisp “heads-up” when price action flips from meh to interesting. Use it as your entry timing engine, wrap it with risk discipline, and you’ll have a clean, repeatable process you can actually stick to. Coz at the end of the day, consistency beats everything.

Comments

No comments yet. Be the first to comment!

Leave a Comment