The trading landscape is changing rapidly, and automated systems have become one of the most sought-after tools by modern traders. Among the latest Expert Advisors making waves is the Quantum Baron EA V2.8 MT5, a robot crafted to tackle the high volatility of crude oil markets. Instead of trying to manage entries and exits manually in such a dynamic asset, traders can rely on this EA’s structured approach to identify opportunities and execute trades on their behalf.

This review takes a deep dive into what makes Quantum Baron EA stand out, how it operates, the benefits and risks associated with it, and whether it can truly fit into a trader’s portfolio.

Understanding Quantum Baron EA V2.8 MT5

Quantum Baron EA is a fully automated trading bot designed to run on the MetaTrader 5 platform. The developer optimized this EA specifically for XTIUSD (Crude Oil) trading, using the M30 timeframe. Unlike many forex-focused robots that diversify across multiple pairs, this EA concentrates its logic on a single commodity, refining its strategies for precision.

The central philosophy behind Quantum Baron EA is a long-only grid strategy. That means the bot only places buy positions and scales them when price moves against the initial trade. The assumption is that the oil market eventually reverts upward, providing opportunities to close positions in profit as the recovery unfolds.

Features of Quantum Baron EA

- Market Specialization: Built for crude oil, one of the most liquid and widely traded commodities.

- Grid Mechanism: Automatically layers positions when price dips, aiming to reduce average entry levels.

- Positive Swap Usage: Gains additional edge by holding overnight positions where swaps are favorable.

- Optimized Settings: Version 2.8 introduces improved filters for trend recognition and better money management.

- Hedging Support: Works seamlessly on hedge-enabled accounts.

- Broker Flexibility: Performs best on accounts with tight spreads and low commissions.

Setup and Requirements

To ensure smooth performance, the EA requires certain trading conditions.

- Minimum Deposit: $5,000 or higher is recommended to manage volatility.

- Leverage: Works optimally on 1:500 leverage.

- Account Type: ECN or raw spread accounts deliver the most reliable results.

- Hosting: A stable VPS ensures round-the-clock execution without interruptions.

- Platform: MT5 terminal with hedging mode enabled.

Trading Logic in Detail

At its heart, Quantum Baron EA combines trend filters with a grid-based accumulation strategy. Once conditions align, the system initiates a long trade. If the market moves against the entry, it places additional buy orders at intervals. These layered trades lower the average entry point, allowing profitable exits when prices rebound.

This approach capitalizes on the cyclical nature of crude oil, where price retracements are common. However, it also introduces the possibility of prolonged drawdowns if the market enters a sustained bearish phase.

Advantages of Using Quantum Baron EA

- Automation: Traders save time by letting the bot analyze charts and execute trades.

- Commodity Focus: Provides direct exposure to oil without relying on forex pairs.

- Profit Potential: Grid strategies can capture consistent gains during range-bound or upward-trending periods.

- User-Friendly: Minimal manual adjustments once the initial setup is complete.

- Scalability: Profits can compound over time with disciplined money management.

Disadvantages and Risks

- Drawdown Exposure: Prolonged downtrends in crude oil can pressure accounts heavily.

- High Capital Requirement: Smaller accounts may not withstand volatility in grid setups.

- Single Market Dependence: Since it trades only oil, diversification is limited.

- No Sell Orders: Lack of short trades means missing opportunities in bearish markets.

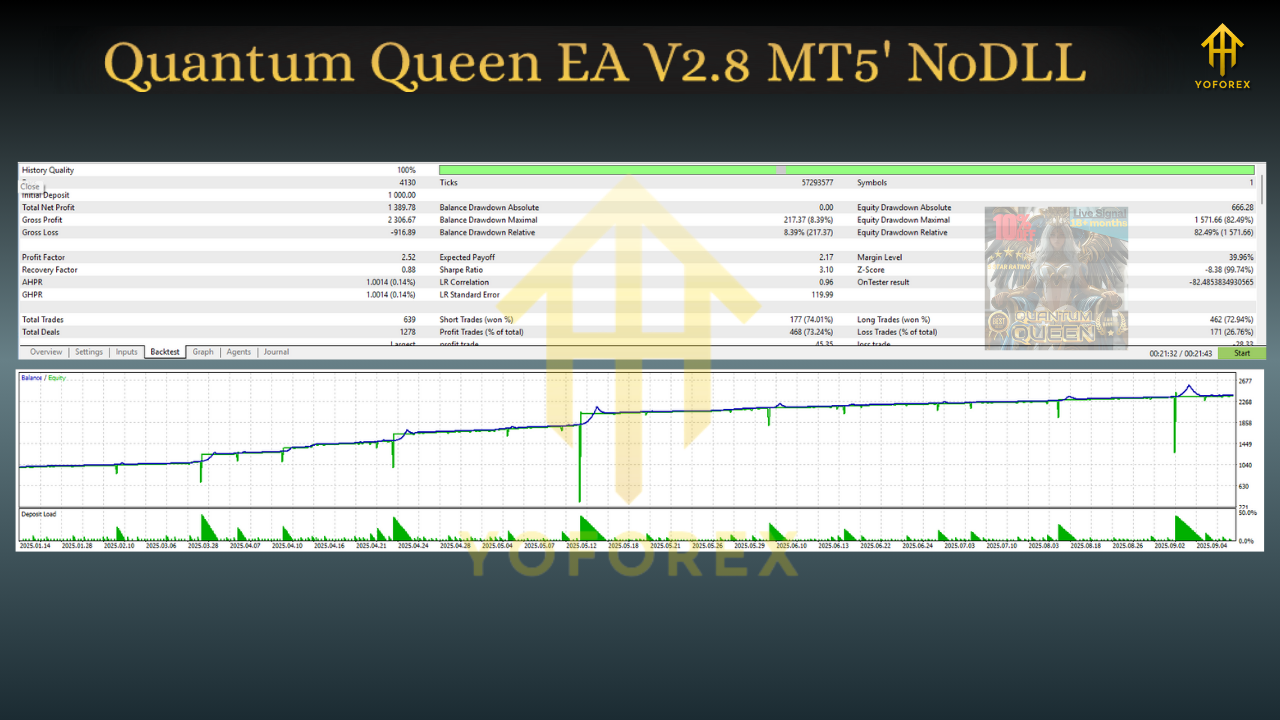

Performance Observations

Quantum Baron EA has shown consistent growth in backtests during bullish and sideways conditions. Users who have tested it live report stable gains in the short term. The EA shines in phases where oil prices recover from dips.

That said, as with all grid-based robots, the real measure of performance lies in how it manages extreme market events. Crude oil can be unpredictable due to geopolitical factors, OPEC decisions, and macroeconomic changes. Traders should not expect smooth profits in every cycle, but instead prepare for phases of stagnation or deeper drawdowns.

Suitability for Traders

Quantum Baron EA V2.8 MT5 is not for everyone. It is better suited for:

- Traders with medium to large capital accounts.

- Those who understand the mechanics of grid strategies.

- Commodity-focused traders who want systematic oil exposure.

- Traders willing to use VPS hosting for uninterrupted execution.

Beginners can use it, but they must start on demo or small allocations to understand the EA’s behavior under different conditions.

Practical Tips for Users

- Risk Management: Allocate capital that you can afford to risk, and avoid over-leveraging.

- Monitoring: Even though it is automated, keep an eye on market news that may affect oil prices.

- Broker Choice: Select a broker with favorable swaps, low spreads, and fast execution.

- Gradual Scaling: Start small and gradually increase lot sizes only after testing.

Final Thoughts

The Quantum Baron EA V2.8 MT5 brings an interesting angle to automated trading by focusing on crude oil with a long-only grid approach. It can generate compelling returns during favorable conditions, but it requires significant capital and careful risk management to survive downturns.

For traders willing to commit to its methodology and manage the risks, it can be a strong addition to a trading portfolio. However, it is not a plug-and-play solution for everyone. Understanding the nature of oil markets and grid strategies is vital before deploying it live.

At ForexFactory.cc, we provide unbiased reviews of such systems to help traders make informed choices. If you are considering Quantum Baron EA, take time to test it, analyze its drawdown tolerance, and align it with your risk profile.

Comments

No comments yet. Be the first to comment!

Leave a Comment