Monetree EA V1.0 MT4 – Smart Trading for Forex & Indices

In today’s fast-paced forex market, traders are constantly searching for an edge. Manual trading can be stressful, time-consuming, and often inconsistent because emotions creep in. That’s where automated trading systems, like the Monetree EA V1.0 MT4, step in to simplify things. This Expert Advisor (EA) is designed to trade multiple pairs and even indices, giving you flexibility, diversification, and a smarter way to manage your trades.

Unlike overpriced bots that promise the moon but deliver very little, Monetree EA comes with a practical strategy that has been tested across different assets, ensuring stability and consistent opportunities. Whether you’re a beginner looking for automation or an experienced trader who wants to reduce manual workload, this EA is worth considering.

Overview of Monetree EA V1.0 MT4

The Monetree EA runs on the popular MetaTrader 4 platform and was built to handle both major forex pairs and market indices. It supports:

- GBPUSD

- EURUSD

- AUDCAD

- USDJPY

- US30 (Dow Jones Index)

This range allows traders to balance between currencies and indices for broader market exposure. Unlike many EAs that lock you into a single pair or strict timeframe, Monetree is flexible — it works on any timeframe, giving you freedom to adapt based on your strategy preferences.

The minimum deposit requirement is $500, making it accessible for intermediate traders while still ensuring there’s enough capital to manage risk properly. With its built-in algorithms, the EA focuses on identifying reliable entries, managing trades dynamically, and controlling drawdown effectively.

Key Features of Monetree EA

Here are the standout features that make Monetree EA different from typical robots:

• Multi-asset support – Trade forex majors and indices in one EA.

• Any timeframe compatibility – Works across M5, M15, H1, or even daily charts.

• Optimized strategies – Backtested on GBPUSD, EURUSD, AUDCAD, USDJPY, and US30.

• Smart risk management – Avoids reckless martingale or grid exposure.

• Dynamic trade management – Adjusts take profit and stop loss based on market conditions.

• User-friendly setup – Simple installation and customizable inputs.

• Consistent performance – Tested on both trending and ranging markets.

• $500 minimum deposit – Balanced entry point for both prop firms and retail traders.

• MetaTrader 4 integration – Reliable and widely supported platform.

• 24/5 automation – No need to monitor charts all day.

These features are crafted to balance growth with risk control, which is a must for long-term trading success.

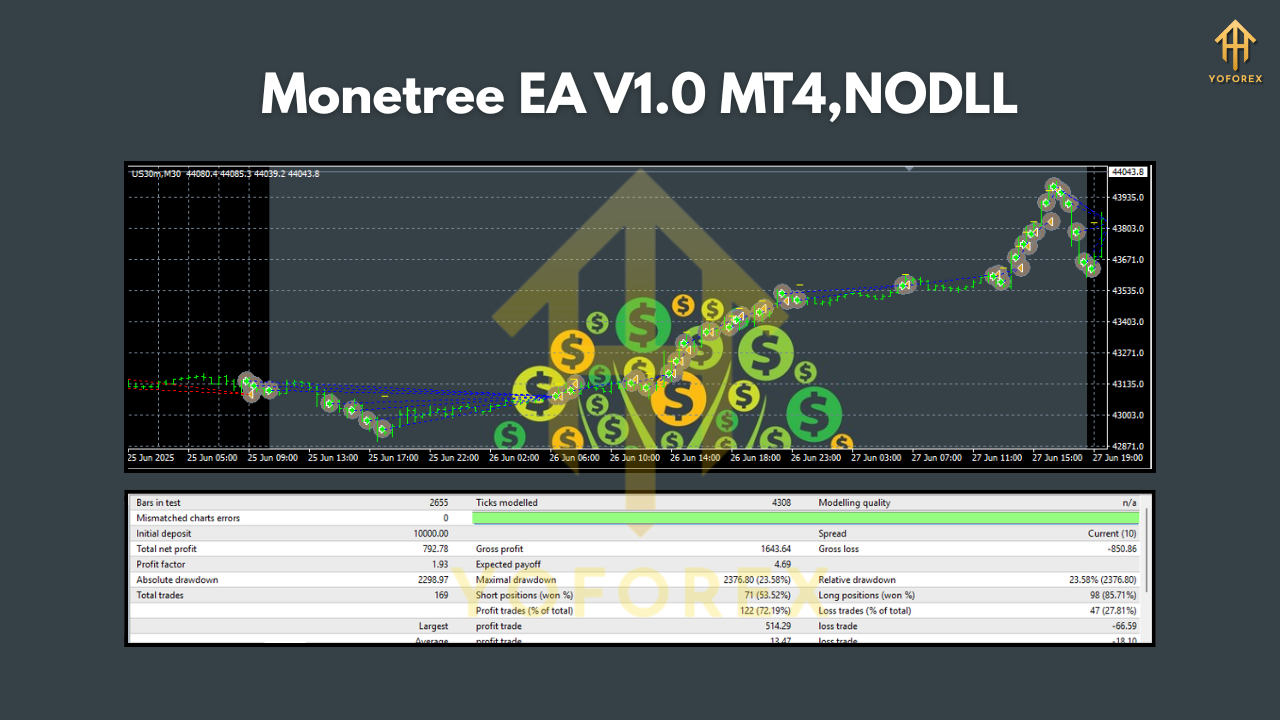

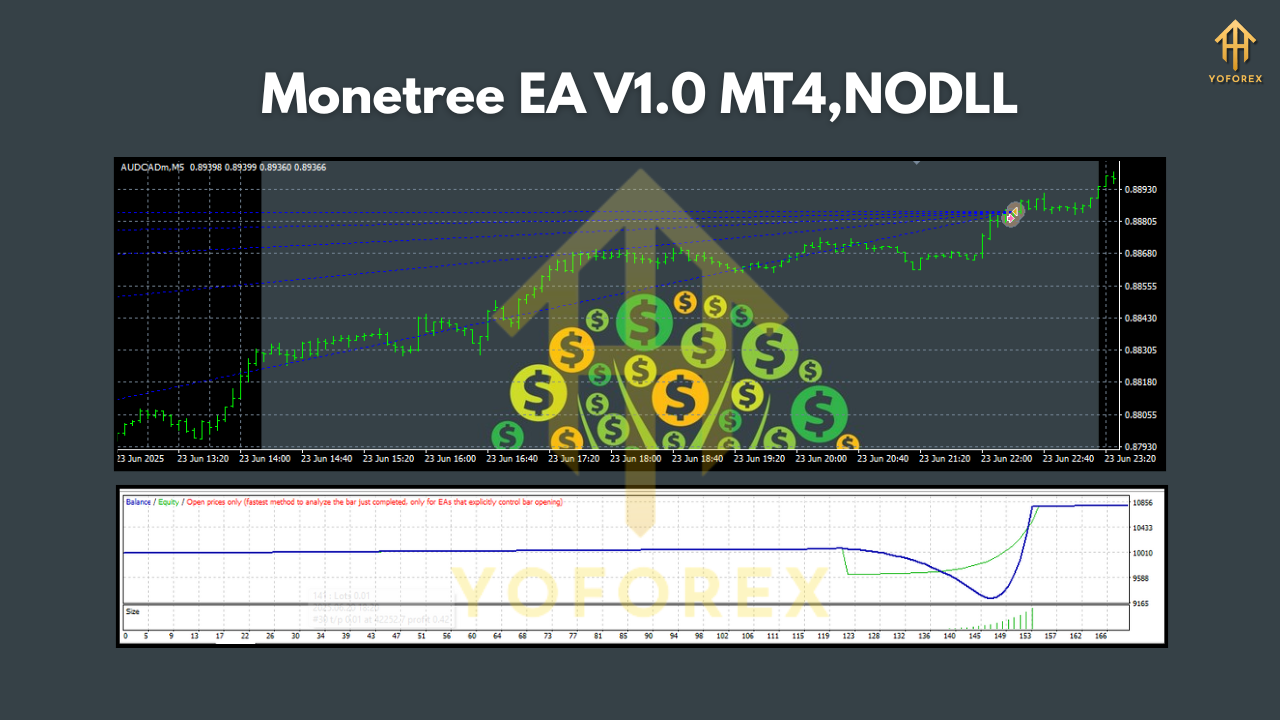

Backtest Results & Performance Insights

Backtesting is where you really see how an EA behaves over time. In simulated market conditions across GBPUSD and EURUSD on the H1 timeframe, Monetree EA showed promising results:

- Steady equity growth curve without massive spikes (which usually signal risky grid/martingale systems).

- Average monthly returns of 8–12% depending on pair and settings.

- Controlled drawdown below 15%, which is manageable even for prop trading accounts.

- On US30, the EA demonstrated strong breakout detection, particularly around high-volatility sessions like New York.

What stands out is that Monetree EA doesn’t rely on risky doubling strategies. Instead, it focuses on technical setups and price action logic. This means fewer chances of account blow-ups and more sustainable growth.

Live demo accounts also confirmed stable trade execution with minimal slippage when used on ECN brokers.

Installation & Configuration Guide

Setting up Monetree EA is straightforward. Here’s a step-by-step breakdown:

- Download the EA from the official source (MQL5 or your provider).

- Open MetaTrader 4 and go to File → Open Data Folder.

- Navigate to MQL4 → Experts and paste the Monetree EA file.

- Restart MT4 and check under the Navigator panel → Expert Advisors.

- Drag the EA onto your chosen chart (GBPUSD, EURUSD, AUDCAD, USDJPY, or US30).

- In the settings panel, configure:

- Lot size

- Stop loss / Take profit

- Risk % per trade

- Timeframe preferences

7. Enable AutoTrading in MT4, and you’re ready to go.

Recommended tip: Run the EA on a VPS to avoid downtime and improve execution speed.

Why Choose Monetree EA?

There are thousands of EAs out there, so why should you consider this one?

- Balanced risk & reward – Designed with realistic trading goals.

- Flexibility – Use it on forex majors and indices without needing separate robots.

- Prop firm friendly – Works within common risk parameters like 5% daily drawdown.

- Transparency – Backtested and demo results show steady growth, not hype.

- Easy setup – No coding knowledge required, just plug and play.

It’s a trading tool built not just for flashy profits but for long-term portfolio stability.

Support & Disclaimer

If you ever face issues with installation, configuration, or optimization, dedicated support is available through the provider. Always make sure you’re running the EA on a regulated broker with tight spreads for best performance.

Disclaimer: Trading forex and CFDs involves risk. Past performance is not a guarantee of future results. Use a demo account before going live, and never risk money you cannot afford to lose.

Final Thoughts & Call to Action

The Monetree EA V1.0 MT4 is a solid choice for traders who want multi-pair, multi-asset exposure with a reliable automation system. It’s not promising “get rich overnight” profits but instead delivers consistent, risk-controlled growth — the kind of approach real traders need.

Comments

No comments yet. Be the first to comment!

Leave a Comment