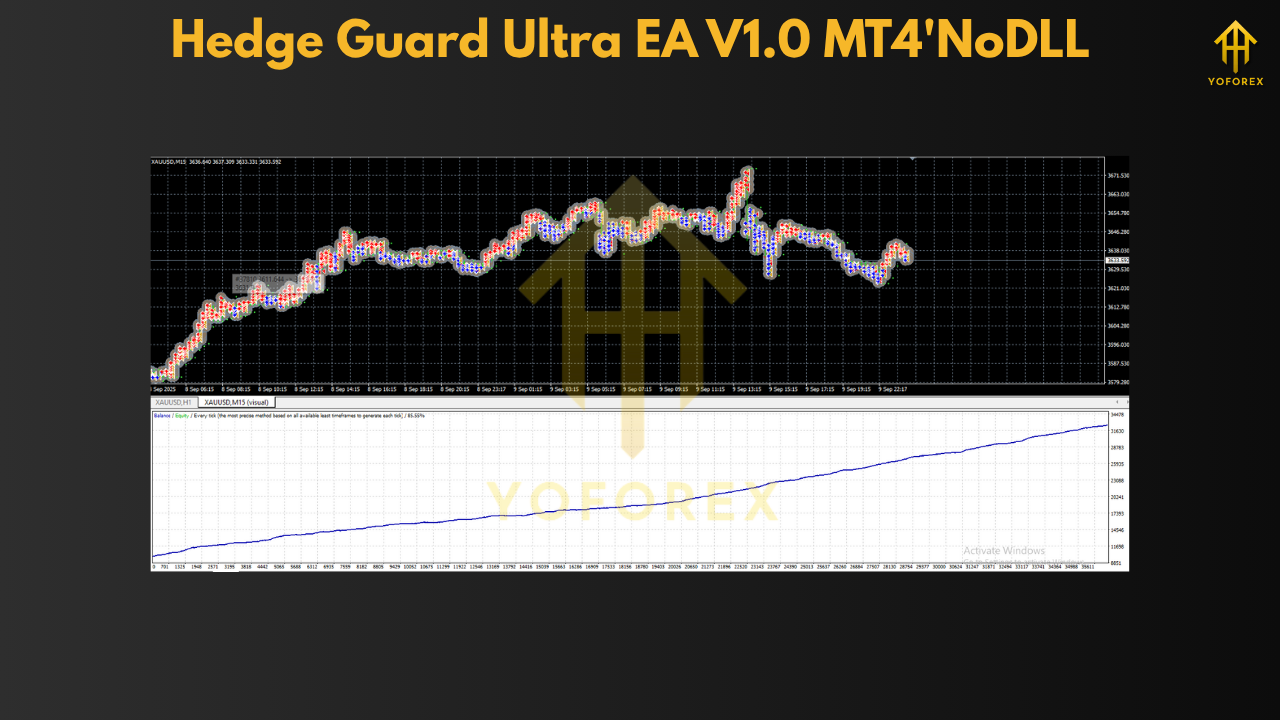

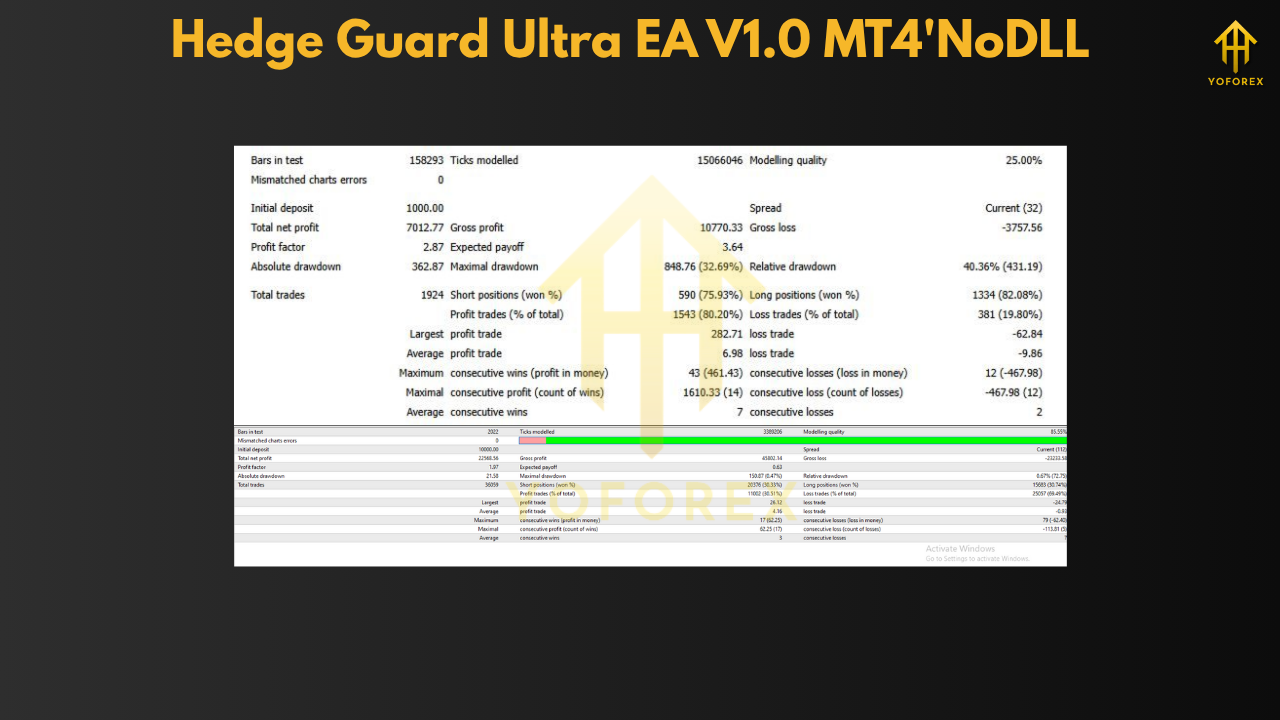

Hedge Guard Ultra EA V1.0 MT4 is a next-generation automated trading system that blends technical accuracy with robust risk control. Designed for traders who value consistency over speculation, this Expert Advisor operates on MetaTrader 4 and uses a smart hedging structure to stabilise performance across both trending and ranging markets.

At its core, the EA follows a volatility-sensitive approach that analyses live price movement through adaptive algorithms. It identifies shifts in market rhythm and opens strategic positions while minimising exposure. Instead of relying on conventional grid or martingale logic, Hedge Guard Ultra EA uses calculated entry and exit points based on real-time volatility behaviour and dynamic thresholds. This makes it suitable for traders aiming to maintain low drawdowns and sustainable growth.

The system manages buy and sell positions simultaneously, allowing partial hedging in volatile situations. This layered protection helps to reduce drawdown impact while maintaining open opportunities for profit recovery. The logic behind Hedge Guard Ultra EA focuses on balancing position sizing and order frequency, ensuring that risk remains proportionate to account equity.

One of the most important aspects of this EA is its ability to adapt. It doesn’t trade blindly. Instead, it studies recent price structures, determines whether momentum aligns with its pre-set volatility zone, and acts accordingly. The algorithm uses calculated pip-distance tracking to define when to trigger a new order or close an existing one. For traders seeking steady account growth without excessive risk-taking, Hedge Guard Ultra EA offers a calculated, methodical solution.

Why Hedge Guard Ultra EA Stands Out

Unlike many trading robots that chase fast profits through aggressive strategies, this EA maintains discipline. Its hedging system acts as a stabiliser, balancing open positions without allowing margin overload. This gives traders time to recover positions and prevents forced stop-outs during short-term volatility spikes.

Another key feature is its flexible equity protection module. The system automatically adjusts its behaviour when account balance fluctuations exceed certain thresholds. This ensures that traders always maintain controlled exposure. The EA can scale back lot sizes or delay new entries depending on account conditions, reducing risk during unstable sessions.

Ideal Conditions and Recommended Settings

Hedge Guard Ultra EA V1.0 MT4 performs best in medium to high volatility markets such as gold (XAUUSD), EURUSD, GBPUSD, and indices like NAS100. It operates effectively on lower timeframes (M1 to M15) but is also stable on higher intervals for those who prefer slower-paced strategies. A minimum balance of $100 is recommended, but the system scales better with $500 or more for diversified pairs.

A VPS is highly advised for 24/7 operation. The EA’s design allows it to run continuously, evaluating conditions even when no immediate trade opportunities exist. This persistent monitoring ensures the system never misses optimal entry points during sudden market reversals.

The Trading Logic Explained

The EA follows a two-stage logic:

- Trend Recognition: It detects direction bias through calculated volatility zones and compares price deviation with average movement ranges.

- Hedging Activation: If an open position encounters adverse movement, a counter-trade is triggered to offset potential losses. Both trades remain active until equilibrium or profit targets are achieved.

This logic allows Hedge Guard Ultra EA to trade both sides of the market intelligently. Rather than relying on random reversals, it uses structured hedge entries that are synchronised with underlying volatility measures.

Performance Stability

What separates this EA from traditional systems is its ability to manage prolonged drawdowns. Even when the market becomes erratic, the EA relies on layered protection rather than doubling exposure. This consistency makes it appealing to traders who focus on steady returns rather than high-risk, short-term gains.

The system’s execution speed is also optimised for low-latency brokers. It opens and closes trades precisely, ensuring minimal slippage and smooth order handling. This stability is particularly beneficial during news spikes or sudden price gaps, where manual traders often struggle to react quickly enough.

Risk Management

Every automated strategy depends on solid risk control, and Hedge Guard Ultra EA excels in this area. It includes features such as:

- Dynamic lot adjustment: Positions scale automatically based on equity and volatility strength.

- Maximum trade cap: Prevents overexposure by limiting the number of simultaneous trades.

- Trailing stop and take-profit modules: Protect accumulated gains and exit early when price momentum fades.

- Capital protection mode: Temporarily halts new trades during sharp market swings or when the balance drops below a safety threshold.

These safeguards allow traders to keep their strategies active without constant supervision while maintaining consistent equity curves.

The Strategic Advantage

What truly makes Hedge Guard Ultra EA unique is its balance between aggression and caution. It can execute multiple-layered trades, yet still maintain control through its internal hedging logic. This feature allows recovery during pullbacks while maintaining long-term equity growth.

Because of its high adaptability, the EA suits both conservative and moderate-risk traders. Those who prefer slower, lower-risk setups can limit order size and frequency, while more experienced users can expand exposure for higher returns under tighter monitoring.

Practical Benefits

- Works seamlessly on MetaTrader 4

- Compatible with all major brokers supporting hedging

- Low system resource consumption

- Stable across multiple currency pairs

- Can run continuously without manual input

- Includes equity stop and take-profit configuration

- Easily customizable settings for all experience levels

Final Thoughts

Hedge Guard Ultra EA V1.0 MT4 represents a step forward for traders who want automation without uncontrolled risk. It doesn’t rely on unrealistic backtests or over-optimised settings. Instead, it provides a structured, data-driven approach to hedging that helps traders maintain stability across unpredictable market phases.

By combining real-time volatility adaptation with consistent hedging principles, the EA delivers a smooth performance curve suitable for long-term portfolio growth. While no trading robot can guarantee profits, Hedge Guard Ultra EA offers one of the most balanced frameworks for sustainable automated trading.

It’s best used as part of a diversified strategy—running alongside other EAs or manual setups—to maintain performance across changing market cycles. Traders seeking to automate while preserving control over risk will find this system both reliable and adaptable.

Comments

No comments yet. Be the first to comment!

Leave a Comment