Golden Apex EA V1.0 MT4 – Precision Scalping for Gold & GBPUSD

If you trade gold, you already know how wild XAUUSD can be—fast moves, fakeouts, spreads that widen at the worst time. Golden Apex EA V1.0 MT4 is built to tame that chaos. It’s a lightweight, speed-focused Expert Advisor that seeks short, repeatable profits on the M1 and M5 timeframes. It thrives on XAUUSD (Gold) and also supports GBPUSD for added diversification. With a sensible minimum deposit of $500, the bot aims to keep risk in check while still taking advantage of high-probability setups. Think of it as your tireless scalper that sticks to rules, cuts losers fast, and lets winners breathe—without drama.

This post breaks down how it works, how to set it up, and the best practices to get the most out of it. No fluff; just a practical guide you can follow today.

What Makes Golden Apex “Apex”?

Golden Apex EA is purpose-built for fast markets. It looks for momentum bursts followed by small pullbacks, then enters with predefined risk so you don’t have to second-guess entries. The logic balances three ideas:

- Trend confirmation: trades align with short-term direction to avoid counter-trend chops.

- Pullback precision: enters after micro retracements to improve price and reduce noise.

- Risk-first execution: fixed stop-loss, take-profit, and optional trailing logic to protect equity.

It won’t chase every candle. It waits for confluence, including spread checks and session filters, to avoid low-quality fills. On XAUUSD, the EA’s quick execution makes sense because gold trends hard and snaps back fast. On GBPUSD, it adds steady opportunities when gold is quiet.

Working Pairs, Timeframes, and Capital

- Pairs: XAUUSD (Gold), GBPUSD

- Timeframes: M1, M5 (M1 for high-frequency scalps; M5 for cleaner signals)

- Minimum Deposit: $500

If you’re new, start with M5 on a demo, then shift to M1 when you’re comfortable with volatility and your broker’s execution quality. Gold demands tight spreads and low slippage, so a solid ECN broker helps a lot.

How the Strategy Operates (Plain English)

- Market scan: the EA tracks short-term trend direction using micro-moving averages and volatility filters.

- Trigger & confirmation: when a burst occurs, it waits for a small pullback; only then does it arm a trade.

- Order placement: it enters with a fixed SL/TP; optional trailing stop takes over if price runs.

- Risk controls: spread filters, time windows, and max open trades prevent over-exposure.

- Session logic: London and New York overlaps are preferred for tighter spreads and better momentum.

This is classic scalper behavior—be quick, be precise, and don’t overstay your welcome.

Quick Setup (Step-by-Step)

- Install the EA: Open MT4 → File → Open Data Folder → MQL4/Experts → copy

GoldenApexEA.ex4(or.mq4) here. - Restart MT4: or right-click Expert Advisors in Navigator and hit Refresh.

- Attach to chart: open XAUUSD or GBPUSD → M1 or M5 → drag Golden Apex EA onto the chart.

- Allow Algo Trading: check “Allow live trading” and enable AutoTrading on the MT4 toolbar.

- Load settings: if you have a

.setfile, click Load in Inputs. Otherwise, use the recommended inputs below. - Run on VPS (optional but smart): improves uptime and execution, especially for M1 scalps.

Recommended Inputs (Baseline)

These are starting points; you can fine-tune per broker and account size.

- Risk Mode: Fixed lot for accounts under $1,500; Percent risk for larger accounts.

- Fixed Lot: 0.01 per $500 (scale cautiously).

- Percent Risk per Trade: 0.5%–1.0% (keep it humble on gold).

- Stop-Loss (SL): 150–250 points on XAUUSD (broker-point format); 120–180 points on GBPUSD.

- Take-Profit (TP): 120–220 points on XAUUSD; 100–160 on GBPUSD.

- Trailing Stop: Start trailing after +80 to +120 points; step trail modestly to avoid whip.

- Max Open Trades: 1–3 (start with 1 on M1 to learn behavior).

- Spread Filter: reject trades above your broker’s typical spread + a small buffer (e.g., 30–40 points on XAUUSD, broker-point format).

- Trading Sessions: enable London + NY; avoid rollover and major high-impact news if your broker widens spreads aggressively.

Practical Risk Management

Golden Apex EA is engineered for frequent, smaller wins. That style needs discipline. A few guardrails:

- Choose one pair first: start with XAUUSD M5 to get a feel for the bot, then test M1 and GBPUSD later.

- Keep risk constant: don’t increase lot size after a loss; stick to plan.

- Daily loss cap: consider a soft stop (e.g., 2%–3%). If hit, stop for the day—no revenge trading.

- Withdraw profits periodically: scaling up is great, but realize gains too.

- Use a VPS: it’s not mandatory, but it’s cheap insurance for stability.

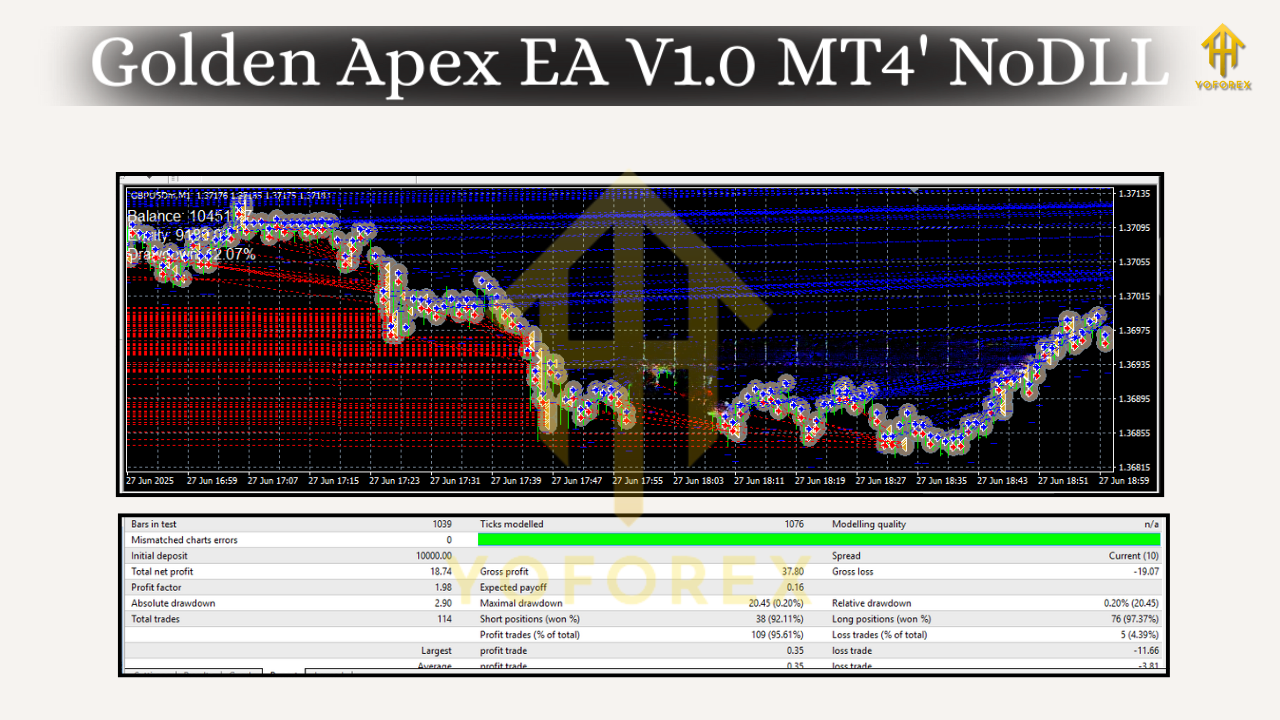

Backtesting and Optimization Tips

Backtests aren’t the future, but they help set expectations. For Golden Apex:

- Model quality: use “Every tick” with high-quality data for M1 and M5.

- Spread: set a realistic average spread, not zero; gold is sensitive.

- Period: test at least 12–24 months to cover different regimes.

- Walk-forward: avoid curve-fitting. Validate on out-of-sample months.

- KPIs to watch: profit factor above 1.3, max drawdown under 25% for your risk settings, average trade duration consistent with a scalper strategy.

Once your baseline is stable, try small tweaks: SL/TP ratios, trailing logic, and spread filters. Don’t over-optimize; consistency beats perfection.

When to Use Each Timeframe

- M1: more signals, higher sensitivity. Best when spreads are tight and execution is strong.

- M5: fewer but cleaner signals. Great for beginners and prop-firm rules where consistency matters.

- Hybrid approach: run M5 during quieter times; switch to M1 during London/NY overlap if your broker holds spreads.

Common Mistakes to Avoid

- Over-leveraging: gold punishes greed. Keep risk per trade low.

- Ignoring spread: if spreads widen, your edge shrinks fast.

- Letting the bot run through rollover/news without filters: be mindful of conditions.

- Stacking too many charts at once: learn the EA’s rhythm on one chart, then scale.

Who Is Golden Apex EA For?

- Active day traders who like quick, rules-based entries and exits.

- Prop-firm challengers who need tight control over daily drawdown.

- Busy traders who want a systematic approach that doesn’t need hand-holding every minute.

Final Word

Golden Apex EA V1.0 MT4 isn’t a magic wand, but it is a sharp, disciplined tool. On XAUUSD and GBPUSD across M1/M5, it hunts for momentum with built-in risk logic so you can focus on the bigger picture—risk, consistency, and steady growth. Start small, respect the process, and let the data guide your adjustments. You’ve got this.

Comments

No comments yet. Be the first to comment!

Leave a Comment