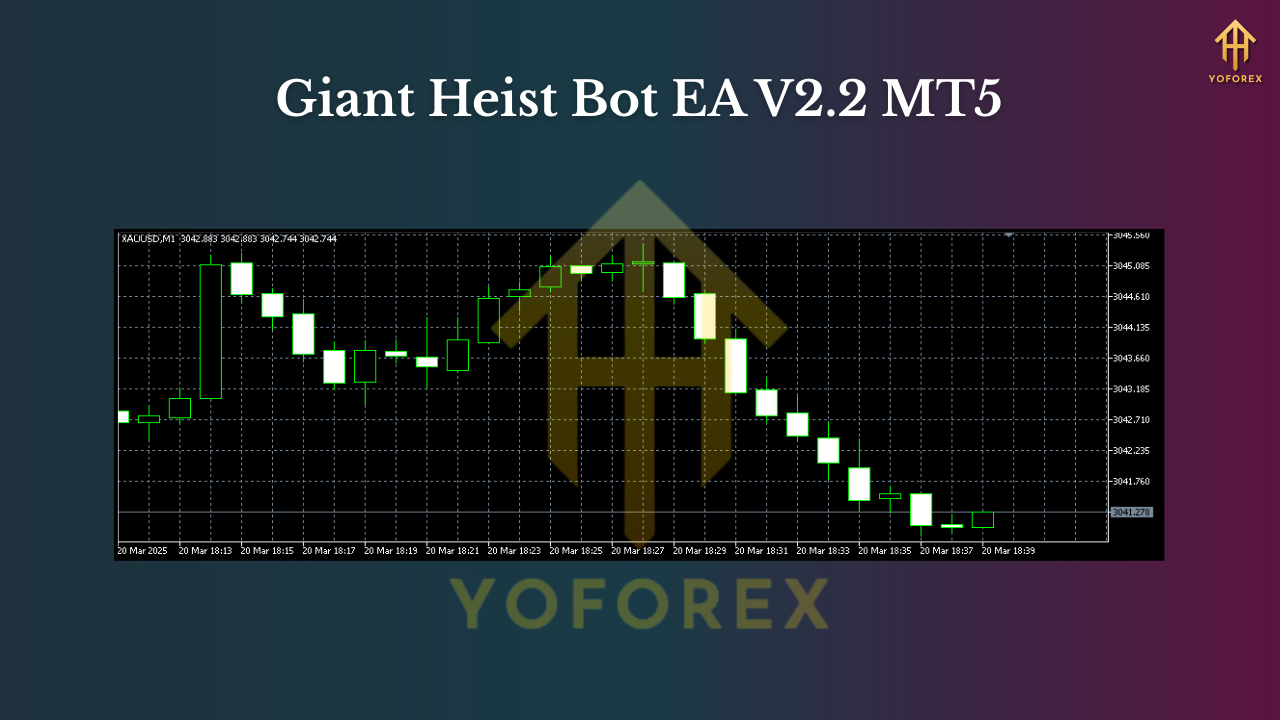

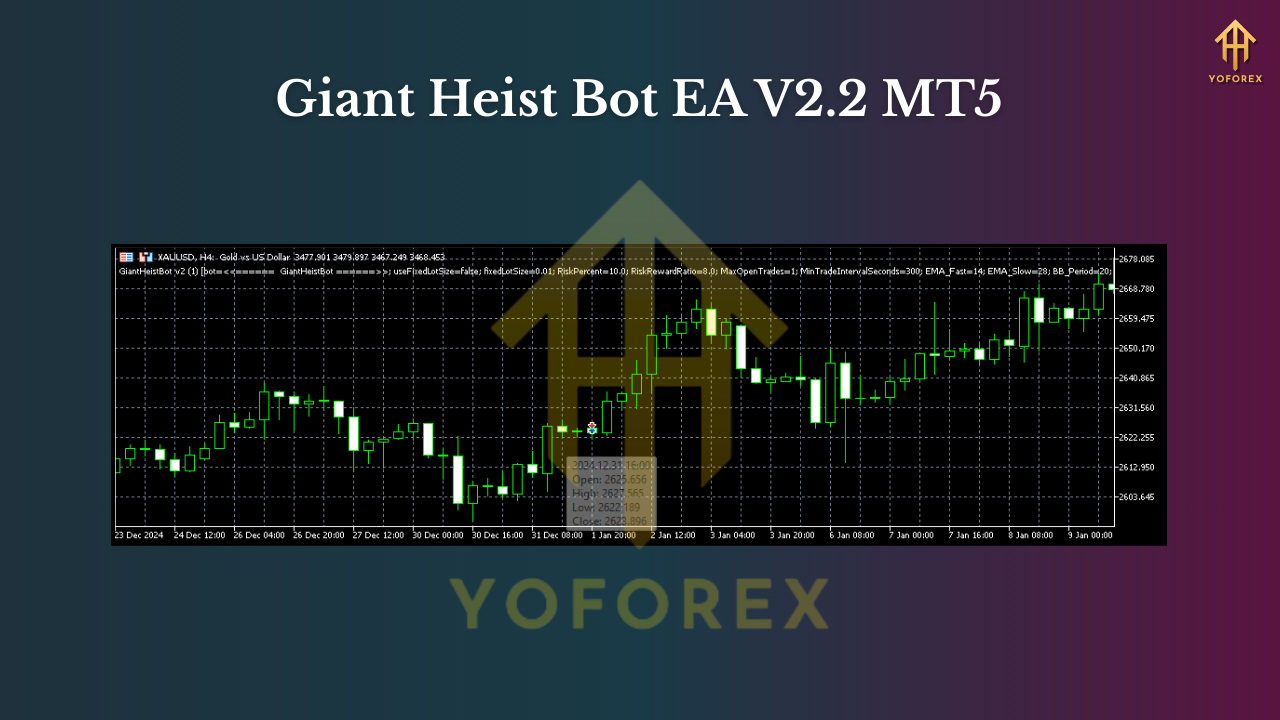

Giant Heist Bot EA V2.2 MT5 — Smart Liquidity Scalper For M1–H4

If you’ve been hunting for an MT5 expert advisor that can actually adapt to market mood—scalp when the tape is fast and step back when conditions get choppy—Giant Heist Bot EA V2.2 might be your new workhorse. It’s built to trade EUR/USD, GBP/USD, and USD/JPY across M1 to H4, so you’re not locked into one narrow style. The idea is simple: identify “liquidity heist” moments (where price grabs stops/liquidity and snaps back) and then ride the clean move with tight risk. You don’t need to babysit every candle; set it up once, tune risk, and let the logic do the heavy lifting—nice.

Below, I’ll walk you through how it works, the setups it looks for, recommended parameters, and a step-by-step install. I’ll keep it straight and actionable—coz you’ve got trades to take.

What Makes Giant Heist Bot Different?

Most retail bots either chase every micro-tick or sit out half the week. Giant Heist Bot EA V2.2 tries to do both smarter and calmer. It looks for “stop hunts”—where price pokes beyond a recent high/low to sweep resting orders—then confirms with momentum and volatility filters before entering. You’ll see:

- Scalping mode on M1–M15 for quick bursts during London and early New York.

- Intra-day/swing mode on M30–H4 for fewer, more deliberate positions.

- Risk control that prioritizes small losses and steady compounding over lottery-ticket trades.

Traders who want prop-firm-friendly behavior (low drawdown, controlled exposure, and consistency) will vibe with this approach.

How It Works (Plain English)

- Session & Volatility Scan

The EA checks if we’re in a liquid session window (London/NY), and whether ATR/volatility is conducive. If spread or slippage spikes, it dials down aggression or sits out. - Liquidity Sweep Detection

Price presses above a recent swing high (or below a swing low), “heists” nearby stops, and leaves a wick/impulse. The EA flags this as a potential reversal/continuation zone. - Confirmation Stack

- Micro-structure shift (higher-low after a sweep of lows, or lower-high after a sweep of highs).

- Momentum kick (e.g., candle body vs range, optional RSI/OBV context).

- ATR-based distance sanity checks and spread filter.

4. Entry & Protective Stop

Entry goes at or after a small pullback; SL is anchored by ATR×multiplier just beyond the swept level, avoiding super-tight stops that get nicked.

5. Exit Logic

- TP uses RR targets (1.2–2.0R typical for scalps; 1.5–3.0R for higher timeframes).

- Partial close may secure a slice at 1R and trail the rest using swing/ATR.

- Equity protector halts new trades if daily loss hits your cap.

This stack keeps entries selective and risk first. No blind averaging down, no crazy martingale.

Recommended Pairs & Timeframes

Pairs: EUR/USD, GBP/USD, USD/JPY (tight spreads, consistent liquidity).

Timeframes: M1–H4.

- M1–M5 (Scalp): EURUSD, USDJPY during London open to mid-London; keep risk modest (0.3–0.7% per trade).

- M15–M30 (Intraday): Great balance for GBPUSD/EURUSD; 0.5–1.0% risk is sensible.

- H1–H4 (Swing): Fewer trades, stronger signals; 0.75–1.5% risk per trade with wider ATR-based stops.

Tip: GBPUSD loves momentum but can be whippy around news—either enable the built-in news filter (if your setup includes one) or set a manual blackout window around major releases.

Core Features You’ll Actually Use

- Liquidity-sweep detection with micro-structure confirmation

- Dual-mode behavior (scalp intraday, swing on higher TFs)

- ATR-anchored SL/TP to adapt to volatility

- Partial take-profit + trailing stop for smooth equity curves

- Session & spread filters to avoid illiquid pockets

- Daily loss guard / equity protector

- Max simultaneous positions & cooldown to reduce overtrading

- Fixed-lot or balance-risk (%) position sizing

- Magic-number isolation for multi-chart deployment

- No martingale grid by default (you can leave that off, seriously)

Settings & Risk Management (Start Here)

- Risk Percent: 0.5% per trade to start. Scale to 0.7–1.0% once you’re confident.

- ATR Multiplier: 1.5–2.2 on M1–M15; 2.0–3.0 on M30–H4.

- TP Logic:

- Scalp: 1.2–1.8R full or 50% at 1R, trail remainder by last swing.

- Higher TF: 1.5–2.5R first target; trail by structure/ATR.

- Max Positions: 1–2 per pair for scalping, 1 for H1–H4.

- Daily Loss Cap: 2–3% (EA stops new entries after hit).

- News Window: Pause 10–15 mins before/after red-folder events, especially for GBP and USD pairs.

Broker/VPS Tips:

Use a low-spread ECN account, 1:200 or higher leverage (but risk small), and a New York or London VPS for lower latency. You don’t need HFT-grade speed, but you don’t want 200ms either.

Example Playbooks

EUR/USD (M15 – London session)

Aim for 1–3 trades/day. ATR×2.0 stops, 1.6R first target, trail balance. Good for steady compounding.

GBP/USD (M5 – London to NY overlap)

Volatile; reduce position size slightly vs EURUSD. Use stricter spread filter and news blackout.

USD/JPY (H1 – End-of-day swing)

Let the Asian session structure form; catch NYC reversals or continuations with wider, calmer targets.

Installation (MT5, step by step)

- Open MT5 → File → Open Data Folder.

- Go to MQL5/Experts and paste the Giant Heist Bot EA V2.2 file (

.ex5). - Restart MT5 or refresh the Navigator panel.

- Drag the EA onto your chosen chart (e.g., EURUSD M15).

- In Common, allow algo trading; in Inputs, set your Risk%, ATR multiplier, session filters, and magic number.

- Save the config as a .set file for reuse across charts.

- Run on demo for a few days to make sure slippage/spreads align with your broker’s reality. Then go small live.

Backtesting & Forward Thinking

Even if you don’t have a decade-long tick dump, you can get a realistic feel by:

- Using Every tick based on real ticks in MT5 for a solid quality backtest.

- Testing London/NY windows rather than 24/5 to see how the session filter refines trades.

- Running walk-forward segments (e.g., 2022 Q1 → Q2–Q3 forward) to spot overfitting.

What you want to see: a steady slope on the equity curve, small clusters of losers (not waterfalls), and flat days when conditions are messy—because good systems sometimes choose not to trade, and that’s a feature, not a bug.

Common Qs (Fast Answers)

Does it martingale?

No, not by default. The philosophy is controlled exposure and compounding, not ballooning drawdowns.

Prop-firm friendly?

Yes—if you keep risk ≤1% and respect daily loss guards and news windows.

Best timeframe to start?

M15 on EURUSD is a sweet spot for most traders. Graduate to M5 scalps or H1 swings after you’re comfy.

Minimum deposit?

$300–$500 on a low-spread broker is practical for micro lots and multiple charts, tho you can test with less on demo.

Final Thoughts

“Liquidity heist” trading done right is less about hero entries and more about timing, filters, and exits. Giant Heist Bot EA V2.2 leans into that—light on fluff, strong on risk logic, and flexible across M1 to H4 on EUR/USD, GBP/USD, and USD/JPY. Start conservative, collect data, nudge risk only when your equity curve says it’s earned.

Join our Telegram for the latest updates and support

Comments

No comments yet. Be the first to comment!

Leave a Comment