Funded Firm V1 VIP EA MT4 — Built to Pass Challenges, Built to Last

If you’ve ever blown a prop-firm challenge on day three (ouch) or felt trapped by tight daily drawdown rules, you’re not alone. Funded Firm V1 VIP EA MT4 is designed precisely for that world—prop challenges, funded accounts, and real-money capital protection. It doesn’t chase every candle; it plays the long game with tight risk, clean execution, and tools that keep you inside the rules even when the market goes full drama. In short: steady, boring, consistent—exactly what funded firms want, and exactly what most EAs forget to prioritize.

What Makes It “Prop-Firm Friendly”

Funded Firm V1 VIP EA MT4 is an automated trading system that emphasizes capital preservation and policy compliance over flashy, short-lived gains. It avoids martingale and grid stacking. It places hard stop losses on every position. It caps exposure by instrument and by day. It includes an optional news filter to dodge high-impact releases, session filters to keep it out of low-liquidity traps, and an equity protector that shuts down trading if your daily loss limit is hit. These aren’t “nice to have” in prop-land—they’re essential.

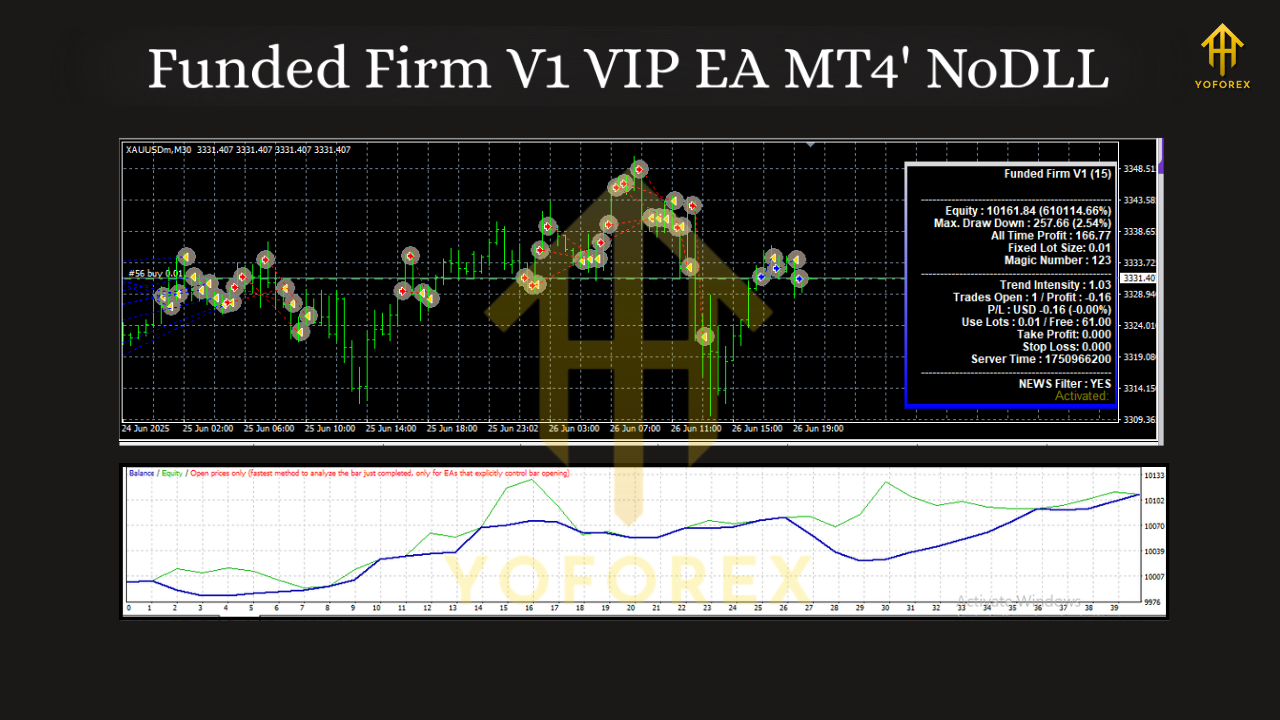

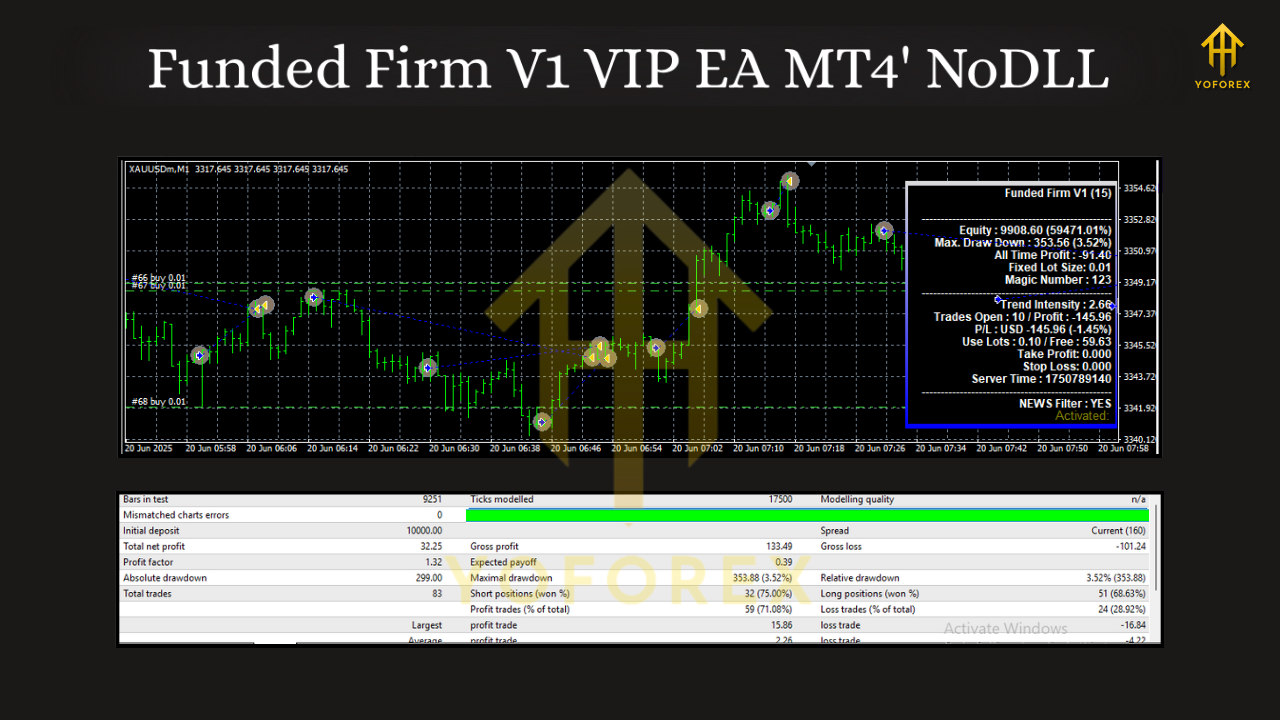

Strategically, the EA combines volatility-aware entries with momentum confirmations. Think of it as a measured breakout/continuation engine that waits for conditions to align: average true range (ATR) risk calibration, multi-timeframe bias, and simple but robust rules for position sizing and exits. The result? Fewer impulsive trades, smaller variance, and a smoother equity line that won’t freak out your risk manager.

Recommended Markets, Timeframes, and Risk

You can run Funded Firm V1 VIP EA MT4 on majors and gold. For most users, EURUSD and XAUUSD are the sweet spot because of liquidity and spread. Timeframes: M15 and H1 are the most “challenge-friendly,” though M5 is available if your broker’s execution and spread are top-notch.

A sensible risk template for prop stages:

- Per-trade risk: 0.25%–0.5% of equity

- Daily equity guard: 3%–4% (stop trading for the day if hit)

- Weekly cap: 6%–8% (optional hard stop to preserve the account)

Minimum deposit? On personal accounts, $300–$500 is workable. On prop challenges, the notional account size covers you—just keep risk per trade tiny and consistent.

Core Features You’ll Actually Use

- No martingale or grid—ever.

- Hard SL on every order; ATR-scaled placement.

- Equity protector: daily/weekly stop-trading rules.

- News filter (optional) to skip high-impact events.

- Session filter: focus on London/NY, avoid dead zones.

- Max trades per symbol and per day (you set the limits).

- Multi-timeframe bias with simple momentum confirmation.

- Trailing stop and break-even logic for winners.

- Works with ECN/STP, hedging accounts; FIFO-aware behavior.

- Detailed journal output so you can audit everything.

These controls aren’t fluff. They’re the difference between finishing Phase 2 with a smile… or explaining to your team why a single NFP spike torched the account.

How the Strategy Manages Entries and Exits

Entries fire when volatility is healthy (not spiky) and momentum confirms the bias. Instead of “catching every break,” the EA looks for continuation setups that align across a shorter and a higher timeframe. If your spread/latency widen, the engine naturally throttles—coz it’s better to miss a trade than take a sloppy fill.

Exits are pragmatic:

- Protective SL from the start; no widening.

- Optional partial take-profits for scaling out.

- ATR-aware trailing stop to lock in trend legs.

- Time-based exit if a trade stagnates beyond a set bar count.

This keeps wins clean and losses contained. You’ll notice fewer “death by a thousand cuts” streaks and a better win/loss expectancy over longer cycles.

Installation & Quick Start (MT4)

- Download the EA file and copy it into

MQL4/Expertsin your MT4 data folder. - Restart MT4, then open Navigator → Experts and drag “Funded Firm V1 VIP EA” onto your chart (start with EURUSD or XAUUSD).

- Allow Algo Trading and DLL imports if required.

- Load the provided

.setfile (or start with defaults), then tweak:

- RiskPercent = 0.25–0.5

- DailyLossStop = 3–4

- NewsFilter = true (skip red-flag events)

- TradingSessions = London/NY

- MaxTradesPerDay = 2–4

5. Let it run on a VPS with low latency. Avoid starting minutes before major news.

Tip: Begin on demo for a full news cycle. Validate broker execution, spreads, and slippage. Then move to the challenge with the exact same settings—no last-minute heroics.

Backtesting the Right Way (So You Don’t Fool Yourself)

Backtests are great for sanity checks, not fortune-telling. Use tick-accurate data if you can, set realistic spread and slippage, and run across multiple years, regimes, and broker conditions. The equity curve you want to see is a gentle climb with shallow pullbacks—not moonshots. If a configuration gives a “perfect” curve, be skeptical; lower risk and test again. Forward testing on a demo during high-impact weeks (FOMC, CPI, NFP) is the best stress test you can do before a challenge.

Prop-Firm Workflow That Works

Phase 1 (Profit Target 8–10%)

- Micro risk: 0.25–0.35% per trade.

- Daily guard 3%. Stop the moment it’s hit; live to fight tomorrow.

- Let the EA compound gently. No “catch-up” after a red day.

Phase 2 (Profit Target 5%)

- Same risk, same rules. The worst mistake here is upping risk because it “feels close.” Consistency wins.

Funded Stage

- Consider tightening risk further to 0.2–0.3%.

- Keep daily/weekly loss protections. You’re playing defense now.

Broker & VPS Notes

Use a reputable ECN/STP broker with raw spreads. Gold spreads should stay tight during liquid hours; if they blow out around rollover, let the session filter sit you out. A stable VPS near your broker’s server matters more than you think—fast in, fast out, fewer slippage surprises.

Troubleshooting Like a Pro

- Too many trades in a choppy day? Lower MaxTradesPerDay and enable time-based exits.

- News spikes clipping stops? Keep the news filter on and extend the lockout window pre/post event.

- Equity swings feel wide? Cut risk per trade; then widen the trailing stop only slightly to avoid death-by-tight-trail.

Why This EA Stays Sane Under Pressure

Most EAs fail prop rules because they’re built to maximize raw return, not survive rules. Funded Firm V1 VIP EA MT4 flips that: it’s engineered to respect risk and maintain composure when the market or your broker gets quirky. No revenge logic. No martingale. Clear daily stops. And the transparency to see exactly why each trade fired.

Final Word

If you want fireworks, this isn’t it. If you want a professional, rules-aware assistant that puts survival first and lets profits accrue over time, then Funded Firm V1 VIP EA MT4 is absolutely worth your next challenge. Start on demo, dial your risk, and let the process work. Pass slow, pass once, and keep the account—because the long game is the only game that pays.

Comments

No comments yet. Be the first to comment!

Leave a Comment