2 Bar Reversal Indicator V1.0 MT4 – Clean Price Action Signals Without Repaint

If you love straight-up price action and hate lag, the 2 Bar Reversal Indicator V1.0 MT4 is going to feel like a breath of fresh air. This non-repaint MetaTrader 4 tool spots the classic two-bar reversal candlestick formation in real time and prints clear buy/sell entries on your chart. No fluff, no funny business—just a simple yet powerful pattern that often marks turning points after a push or exhaustion move. And because the logic is grounded in raw candles (not a smoothed oscillator), signals arrive right when they should. Traders who enjoy clean charts, faster decisions, and objective rules will vibe with this… coz it just works.

What Is the 2-Bar Reversal Pattern?

The two-bar reversal is a compact price action story told in just two candles:

- In a bullish two-bar reversal, the market first prints a bearish (down) candle, then immediately follows with a stronger bullish (up) candle that engulfs or decisively overcomes the prior candle’s body or key levels—hinting that buyers just took over short-term control.

- In a bearish two-bar reversal, the opposite happens: a bullish candle is followed by a decisive bearish candle that invalidates that strength and suggests sellers are back in charge.

Because it’s quick and clear, the pattern can foreshadow trend shifts or quality pullback entries; you’re reading order-flow psychology without overcomplicating things.

How the 2 Bar Reversal Indicator V1.0 MT4 Works

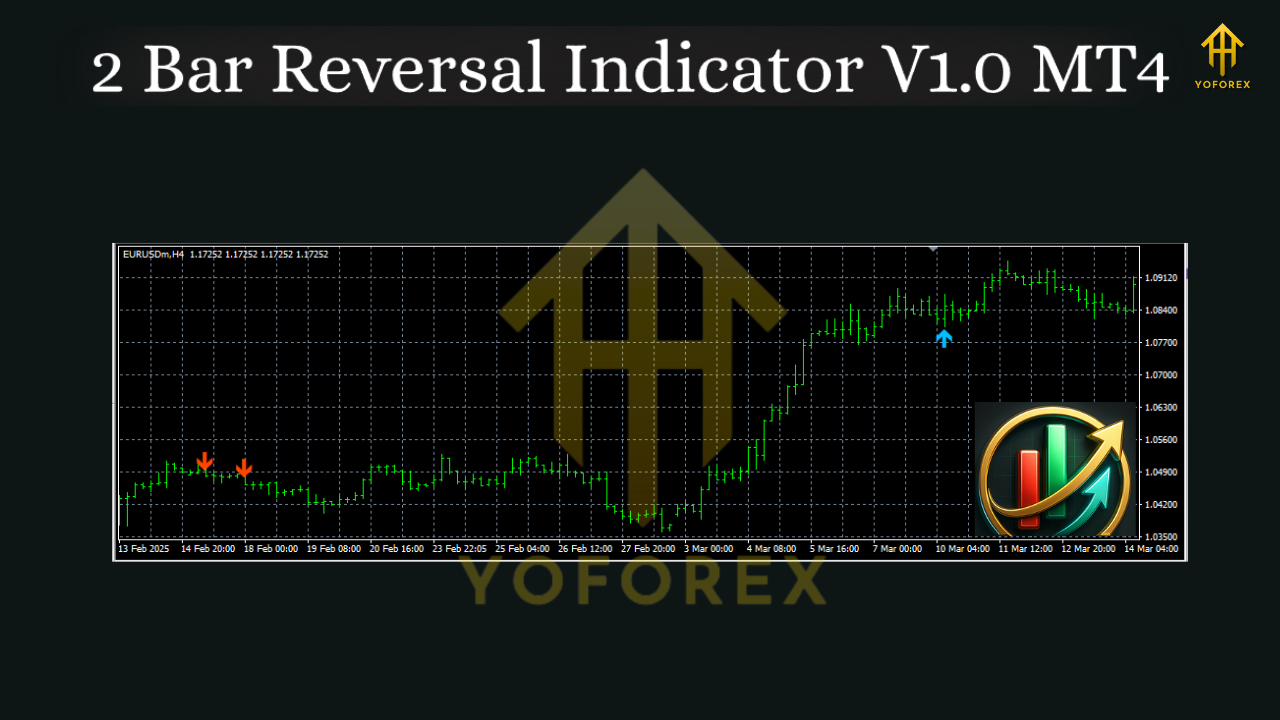

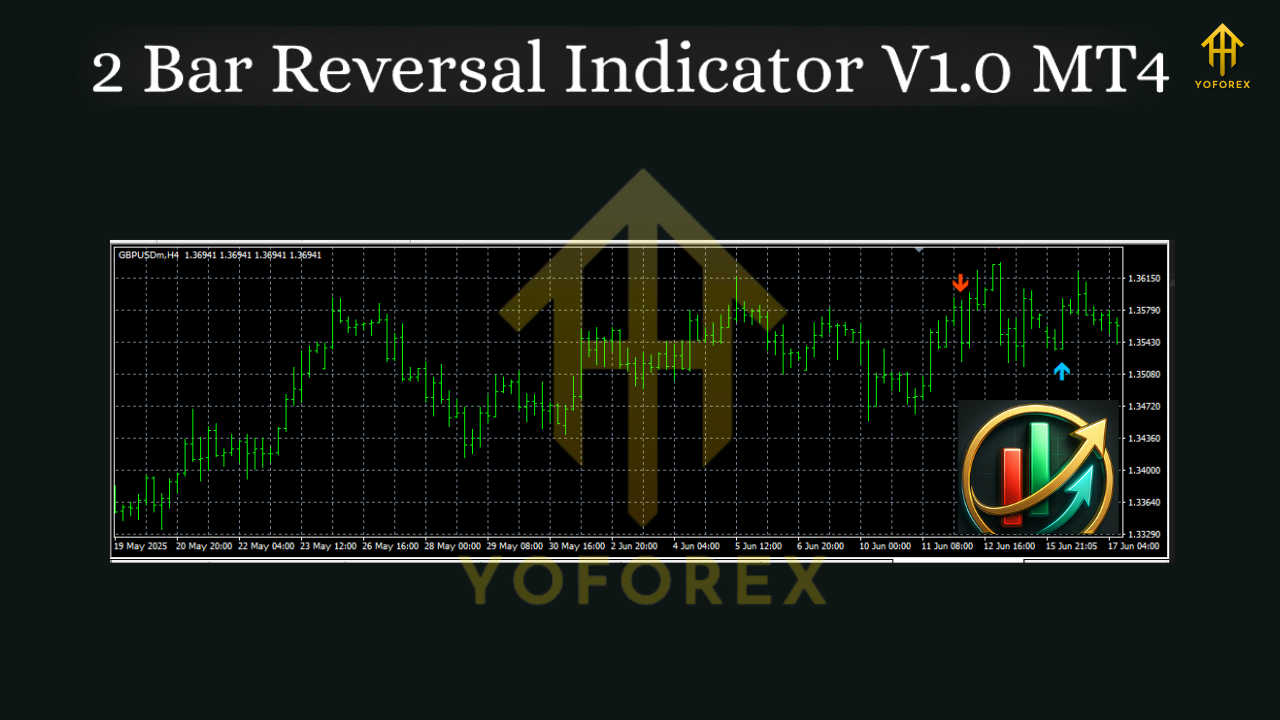

This indicator scans each new candle on your chosen symbol and timeframe, seeking the necessary two-candle relationship (body structure, range dominance, or engulfing characteristics). When conditions align, it:

- Plots an arrow (or icon) on the chart at the signal candle.

- Labels the direction (Buy for bullish, Sell for bearish) for quick visual filtering.

- Avoids repainting by locking signals once the bar closes, so what you see today is what the indicator showed live at the time.

- Optionally alerts you the instant a valid pattern completes (push alerts, pop-ups, or email—depending on your MT4 settings).

The logic is intentionally minimalistic. You’re not getting dozens of conflicting filters; you’re getting a clean, repeatable structure that you can combine with your favorite trade management rules.

Key Features at a Glance

• Non-repaint logic—signals remain fixed once printed

• Buy/Sell entries marked directly on the chart for zero guesswork

• Works on all MT4 timeframes (M1 to MN1) and most liquid symbols

• Multi-asset friendly (FX majors/minors, gold, indices, even crypto CFDs if offered by your broker)

• Optional alerts (on-screen, push, email) so you don’t babysit charts

• Customizable visuals (arrow style/size/color, label positions)

• Lightweight code—low CPU usage, suitable for multi-chart scanning

• No martingale, no grid—it’s an indicator, not an EA; you keep full control

• Great for confluence with S/R, trendlines, moving averages, volume/volatility filters

• Clear rules ideal for prop-firm style discipline and journaling

When to Use It (Timeframes, Pairs, Sessions)

- Timeframes: The pattern appears across M5–H4 most usefully. On lower TFs (M1–M5) you’ll see more signals but also more noise; on higher TFs (H4–D1) you’ll get fewer but often more meaningful setups.

- Pairs/Markets: EURUSD, GBPUSD, USDJPY, XAUUSD (Gold) are popular. Stick with tight spreads and consistent liquidity.

- Sessions: London and New York sessions tend to produce the best follow-through. Asian session can be choppier—use tighter filters there.

Trading the Signal: Simple Rules That Work

Here’s a straightforward playbook you can tweak to your style:

Long Setup (Bullish Two-Bar Reversal)

- Wait for the indicator to print a Buy arrow.

- Confirm price is near a key level (prior swing low, demand zone, round number, or dynamic support such as the 50/200 EMA).

- Entry: Market or stop order above the signal candle’s high.

- Stop-Loss: A few pips below the pattern’s low (or below nearby structure).

- Take-Profit:

- Conservative: 1R–1.5R (prop-friendly)

- Balanced: Prior swing high or 2R

- Aggressive: Trail behind swing lows or an ATR-based stop for trend riding.

Short Setup (Bearish Two-Bar Reversal)

Mirror the above logic: sell below the signal candle’s low, stop above the pattern’s high, target fixed R or structure.

Pro tip: Layer in a trend filter (e.g., price above/below a 50 EMA) and a basic volatility check (ATR rising) to avoid ranging chop. Small touch, big difference.

Settings You’ll Actually Use

- Signal Strictness: Choose whether the second candle must engulf the first candle’s body or if a decisively dominant close is enough.

- Arrow & Label Options: Size, color, and placement so your chart stays readable.

- Alert Toggle: On/off for desktop pop-up, push, or email.

- Backtest Mode: Ensure signals only plot on close (default) for cleaner historical review.

Keep defaults to start; refine as you collect screenshots and outcomes in your trading journal.

Backtesting & Forward Testing: What to Expect

Backtesting a raw price action pattern without filters will show you an edge in context, not a miracle rate in isolation. In historical walkthroughs (bar-by-bar), the 2 Bar Reversal often performs best when confluenced with:

- A dominant higher-timeframe bias (e.g., H4 trend).

- Support/resistance proximity (rejections are cleaner).

- Fresh momentum after news or session opens.

Expect strings of quick scalps on lower TFs and fewer, bigger runners on higher TFs. Forward testing on demo (or tiny live risk) is essential; you’ll quickly learn which pairs and sessions “click” for your style. Don’t be surprised if a basic 1:1.5R take-profit with a ~45–55% win rate outperforms fussier ideas—especially when you remove revenge trades and stick to the plan. Sounds simple… because it is.

Risk Management (The Grown-Up Part)

- Fixed fractional risk per trade (e.g., 0.5–1%).

- Daily loss cap (e.g., 2–3%)—stop trading for the session if hit.

- News filter: If you must trade around news, widen stops or wait for the first post-news pullback signal.

- No averaging down. The pattern is meant to catch turns, not to build hope.

Installation & Setup (MT4)

- Download the indicator file (

.ex4/.mq4). - In MT4, go to File → Open Data Folder.

- Navigate to MQL4 → Indicators and paste the file.

- Restart MT4 (or right-click Indicators → Refresh in the Navigator).

- Drag 2 Bar Reversal Indicator V1.0 onto your chart.

- Tweak inputs (alerts, visuals), click OK. Done!

Best Practices & Tips

- Combine with structure. Only take signals that align with nearby support/resistance.

- Higher-TF bias. Trade long signals when H4/D1 bias is up; shorts when it’s down.

- Avoid dead zones. Super-low volatility periods produce fakeouts.

- Screenshot & journal. Track entry candle context, stop placement, R multiple, and session.

- Stay consistent. The pattern’s edge shines when you apply it the same way every time.

Who Is It For?

- Price action purists who want objective entries without repaint drama.

- Prop-firm aspirants needing mechanical rules with clean R:R.

- Swing traders on H1–H4 who want fewer, higher-quality turns.

- Intraday traders on M5–M15 who love simple confluence stacks (EMA + S/R + 2-bar).

If you’re after a clean, non-repaint, MT4-native confirmation that respects raw candles, this indicator fits like a glove.

Final Word

The 2 Bar Reversal Indicator V1.0 MT4 gives you a battle-tested price action trigger with clean visuals, instant recognition, and zero repaint headaches. Keep the rules tight, respect risk, and let the market tell its story in just two candles. You’ll be surprised how often that’s all you need.

Comments

No comments yet. Be the first to comment!

Leave a Comment